Bonus for Central Government Employees

Non-Productivity Linked Bonus for 30 days with monthly salary ceiling of Rs. 7000 for the year 2018-19 approved

Maximum bonus a Central Government Employee will get is Rs. 6908/-

CONTENTS OF LETTER

Sub: Grant of Non-Productivity Linked Bonus (ad-hoc bonus)

to Central Government Employees for the year 2018-19.

The undersigned is directed to convey the sanction of the

President to the grant of Non-Productivity Linked Bonus (Ad-hoc Bonus)

equivalent to 30 days emoluments for the accounting year 2018-19 to the Central

Government employees in Group ‘C’ and all non-gazetted employees in Group ‘B’,

who are not covered by any Productivity Linked Bonus Scheme. The calculation

ceiling for payment of ad-hoc Bonus under these orders shall be monthly

emoluments of Rs.7000/-, as revised w.e.f 01/04/2014 vide OM No.7/4/2014- E.III(A),

dated 29th August, 2016. The payment of ad-hoc Bonus under these orders will

also be admissible to the eligible employees of Central Para Military Forces

and Armed Forces. The orders will be deemed to be extended to the employees of

Union Territory Administration which follow the Central Government pattern of

emoluments and are not covered by any other bonus or ex-gratia scheme.

2. The benefit will be admissible subject to the following

terms and conditions:-

(i) Only those employees who were in service as on 31.3.2019

and have rendered at least six months of continuous service during the year

2018-19 will be eligible for payment under these orders. Pro-rata payment will

be admissible to the eligible employees for period of continuous service during

the year from six months to a full year, the eligibility period being taken in

terms of number of months of service (rounded off to the nearest number of

months);

(ii) The quantum of Non-PLB (ad-hoc bonus) will be worked

out on the basis of average emoluments/calculation ceiling whichever is lower.

To calculate Non-PLB (Ad-hoc bonus) for one day, the average emoluments in a

month will be divided by 30.4 (average number of days in a month). This will,

thereafter, be multiplied by the number of days of bonus granted. To

illustrate, taking the calculation ceiling of monthly emoluments of Rs. 7000

(where actual average emoluments exceed Rs. 7000), Non-PLB (Ad-hoc Bonus) for

thirty days would work out to Rs. 7000×30/30.4=Rs.6907.89 (rounded off to

Rs.6908/-).

(iii) The casual labour who have worked in offices following

a 6 day week for at least 240 days for each year for 3 years or more (206 days

in each year for 3 years or more in the case of offices observing 5 day week),

will be eligible for this Non-PLB (Ad-hoc Bonus) Payment. The amount of Non-PLB

(ad-hoc bonus) payable will be (Rs.1200×30/30.4 i.e.Rs.1184.21 (rounded off to

Rs.1184/-). In cases where the actual emoluments fall below Rs.1200/- p.m., the

amount will be calculated on actual monthly emoluments.

(iv) All payments under these orders will be rounded off to

the nearest rupee.

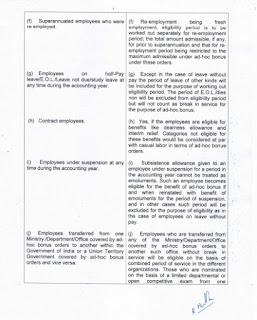

(v) Various points regarding regulation of Ad-hoc / Non- PLB

Bonus are given in the Annexure.

3. The expenditure on this account will be debitable to the

respective Heads to which the pay and allowances of these employees are

debited.

4. The expenditure to be incurred on account of Non-PLB

(Ad-hoc Bonus) is to be met from within the sanctioned budget provision of

concerned Ministries/Departments for the current year.

5. In so far as the persons serving in the Indian Audit and

Accounts Department are concerned, these orders are issued in consultation with

the Comptroller and Auditor General of India.

(B K Manthan)

Deputy Secretary.

Deputy Secretary.

No comments:

Post a Comment

Please give your valuable comments.